The Main Principles Of 1031 Exchange Fund

Table of ContentsThe 1031 Exchange Rules California 2022 PDFsThe 5-Second Trick For 1031 Exchange Rules California 2022What Does 1031 Exchange California Do?The Only Guide to 1031 Exchange Rules CaliforniaUnknown Facts About What Is A 1031 Exchange CaliforniaWhat Is A 1031 Exchange - Questions

Within 45 days of the transfer of the residential property, a home for exchange need to be determined, and also the transaction has to be accomplished within 180 days. Like-kind properties in an exchange need to be of comparable worth. The distinction in worth between a building and also the one being exchanged is called boot.If individual property or non-like-kind residential property is used to finish the purchase, it is also boot, yet it does not disqualify for a 1031 exchange. The visibility of a home mortgage is permitted on either side of the exchange. If the home loan on the substitute is much less than the mortgage on the property being offered, the distinction is dealt with like cash money boot.

Costs as well as costs affect the worth of the transaction and also as a result the potential boot also. Some expenditures can be paid with exchange funds. These include: Broker's compensation Certified intermediary costs Declaring fees Relevant lawyer's costs Title insurance policy costs Relevant tax obligation adviser fees Finder fees Escrow fees Expenses that can not be paid with exchange funds include: Financing charges Real estate tax Repair service or upkeep expenses Insurance premiums LLCs can just trade building as an entity, unless they do a in instance some companions intend to make an exchange and others do not.

What Is A 1031 Exchange California for Dummies

1031 exchanges are accomplished by a solitary taxpayer as one side of the deal. Unique steps are required when members of an LLC or partnership are not in accord on the disposition of a residential or commercial property. This can be quite intricate due to the fact that every homeowner's situation is distinct, however the essentials are global.

A 1031 exchange is carried out on properties held for investment. Or else, the companion(s) participating in the exchange may be seen by the Internal revenue service as not satisfying that criterion. 1031 exchange california.

This is understood as a "swap as well as drop." Like the decrease as well as swap, tenancy-in-common exchanges are an additional variant of 1031 transactions. Tenancy alike isn't a joint venture or a partnership (which would certainly not be permitted to take part in a 1031 exchange), yet it is a partnership that allows you to have a fractional ownership passion directly in a big residential property, along with one to 34 more people/entities.

Not known Details About What Is A 1031 Exchange California

Tenancy in typical can be made use of to separate or consolidate economic holdings, to diversify holdings, or gain a share in a much larger possession.

Some Known Incorrect Statements About Capital Gains Taxes In California

The tax deferment supplied by a 1031 exchange is a wonderful opportunity for financiers. It is complicated at factors, those intricacies enable for an excellent deal of versatility. This is not a treatment for a capitalist acting alone. Proficient specialist support is needed at virtually every action. CWS Resources Partners has experience handling the entire 1031 exchange process for you and also can deal with you to offer replacement possessions when you need them.

The information supplied here is for your general educational functions only. CWS has actually made this third celebration details offered from writers it believes are educated as well as dependable sources.

The Buzz on What Is A 1031 Exchange California

You should familiarize yourself with all risks related to any financial investment product before spending. Advisory services are offered by CWS Capital Partners LLC, a licensed financial investment advisor. Stocks used by CWS Funding Partners LLC are via an associated entity, CWS Investments. CWS Investments is an authorized Broker Dealer, participant,.

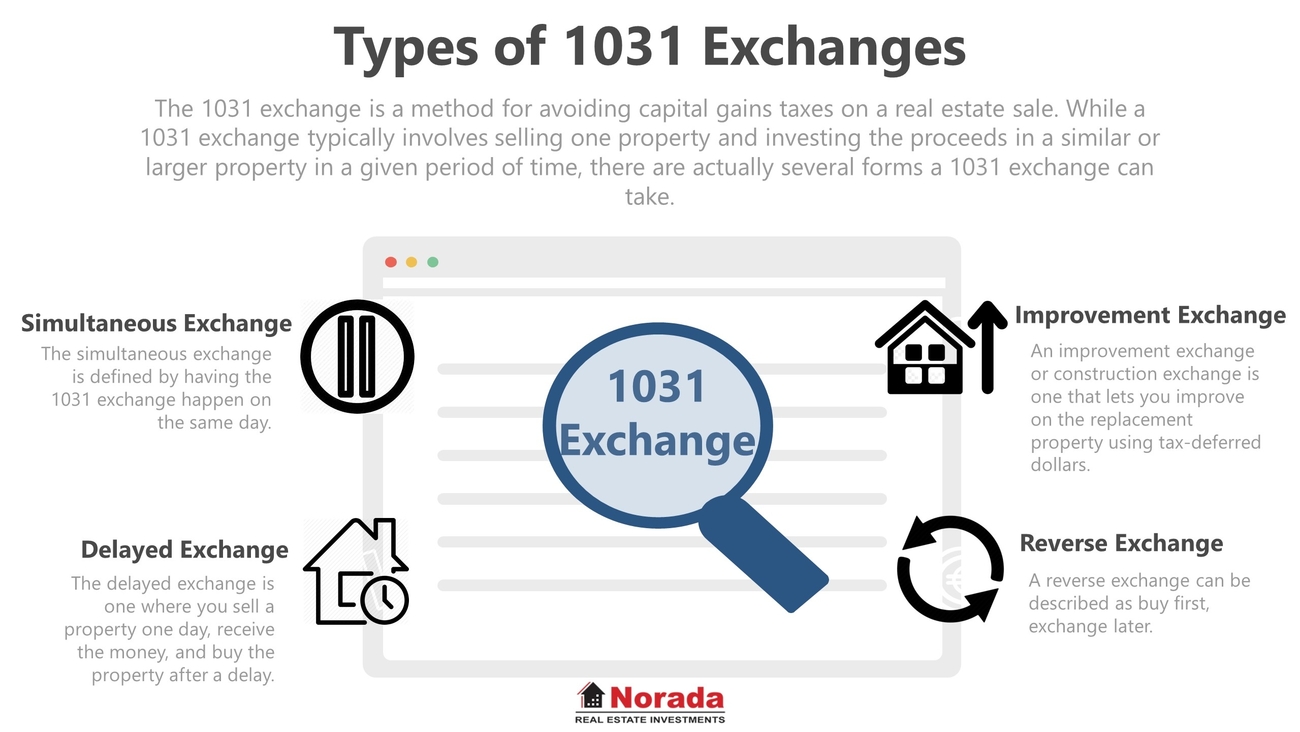

A 1031 exchange is a kind of real estate purchase enabled under Section 1031 of the United States Internal Revenue Code."Exactly how a 1031 exchange jobs, The precise 1031 exchange procedure depends on the type you're utilizing (extra on this later).

Then, like numerous investors, you'll most likely intend to have a qualified intermediary hold the proceeds of your sale till you have actually recognized the home or buildings you would love to buy. After that, you have 45 days to find your substitute financial investment as well as 180 days to purchase it. You can anticipate a qualified intermediary to cost around $600 to $1,200, depending on the deal.

Rumored Buzz on 1031 Exchange Rules

For residential rental buildings, the additional resources benefit is progressively spread out over 27 years. Commonly, if you utilized devaluation to your benefit, then you 'd owe what's called depreciation regain - or income taxes on the economic gains you recognized from doing so - as soon as you sell the house. Making use of a 1031 exchange can permit you to push these repayments bent on a later date. what is a 1031 exchange.

You'll still owe a range of shutting prices and also various other fees for purchasing and marketing a residential property (news). Several of these might be covered by exchange funds, however there's argument around exactly which ones. To discover which expenses as well as charges you might owe for a 1031 exchange deal, it's finest to speak with a tax obligation professional.